The following is a heuristic analysis of GBTC outflows and is not intended to be strictly mathematical, but instead to serve as a tool to help people understand the current state of GBTC selling from a high level, and to estimate the scale of future outflows that may occur.

Number Go Down

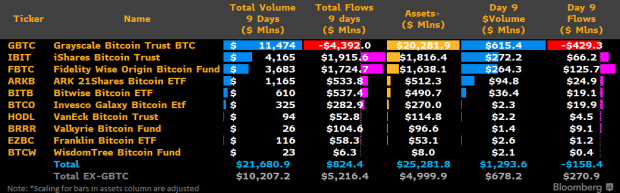

January 25, 2024 – Since Wall Street came to Bitcoin under the auspices of Spot ETF approval, the market has been met with relentless selling from the largest pool of bitcoin in the world: the Grayscale Bitcoin Trust (GBTC) which held more than 630,000 bitcoin at its peak. After conversion from a closed-end fund to a Spot ETF, GBTC’s treasury (3% of all 21 million bitcoin) has bled more than $4 billion during the first 9 days of ETF trading, while other ETF participants have seen inflows of approximately $5.2 billion over that same period. The result – $824 million in net inflows – is somewhat surprising given the sharply negative price action since the SEC lent its stamp of approval.

In trying to forecast the near-term price impact of Spot Bitcoin ETFs, we must first understand for how long and to what magnitude GBTC outflows will continue. Below is a review of the causes of GBTC outflows, who the sellers are, their estimated relative stockpiles, and how long we can expect the outflows to take. Ultimately these projected outflows, despite being undoubtedly large, are counterintuitively extremely bullish for bitcoin in the medium-term despite the downside volatility that we have all experienced (and perhaps most did not expect) post ETF-approval.

The GBTC Hangover: Paying For It

First, some housekeeping on GBTC. It is now plainly clear just how important of a catalyst the GBTC arbitrage trade was in fomenting the 2020-2021 Bitcoin bull run. The GBTC premium was the rocket fuel driving the market higher, allowing market participants (3AC, Babel, Celsius, Blockfi, Voyager etc.) to acquire shares at net asset value, all the while marking their book value up to include the premium. Essentially, the premium drove demand for creation of GBTC shares, which in turn drove bidding for spot bitcoin. It was basically risk free…

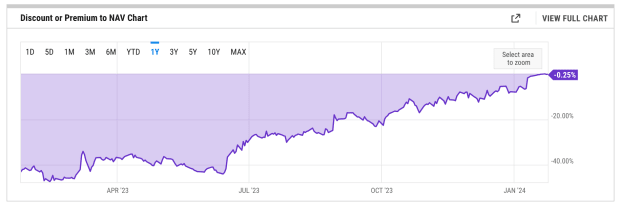

While the premium took the market higher during the 2020+ bull run and billions of dollars poured in to capture the GBTC premium, the story quickly turned sour. As the GBTC golden goose ran dry and the Trust began trading below NAV in February 2021, a daisy chain of liquidations ensued. The GBTC discount essentially took the balance sheet of the entire industry down with it.

Sparked by the implosion of Terra Luna in May 2022, cascading liquidations of GBTC shares by parties like 3AC and Babel (the so-called “crypto contagion”) ensued, pushing the GBTC discount down even further. Since then, GBTC has been an albatross around the neck of bitcoin, and continues to be, as the bankruptcy estates of those hung out to dry on the GBTC “risk free” trade are still liquidating their GBTC shares to this day. Of the aforementioned victims of the “risk free” trade and its collateral damage, the FTX estate (the largest of those parties) finally liquidated 20,000 BTC across the first 8 days of Spot Bitcoin ETF trading in order to pay back its creditors.

It is also important to note the role of the steep GBTC discount relative to NAV and its impact on spot bitcoin demand. The discount incentivized investors to go long GBTC and short BTC, collecting a BTC-denominated return as GBTC crept back up toward NAV. This dynamic further siphoned spot bitcoin demand away – a toxic combination that has further plagued the market until the GBTC discount recently returned to near-neutral post ETF approval.

With all that said, there are considerable quantities of bankruptcy estates that still hold GBTC and will continue to liquidate from the stockpile of 600,000 BTC that Grayscale owned (512,000 BTC as of January 26, 2024). The following is an attempt to highlight different segments of GBTC shareholders, and to then interpret what additional outflows we may see in accordance with the financial strategy for each segment.

Optimal Strategy For Different Segments Of GBTC Owners

Simply put, the question is: of the ~600,000 Bitcoin that were in the trust, how many of them are likely to exit GBTC in total? Subsequently, of those outflows, how many are going to rotate back into a Bitcoin product, or Bitcoin itself, thus largely negating the selling pressure? This is where it gets tricky, and knowing who owns GBTC shares, and what their incentives are, is important.

The two key aspects driving GBTC outflows are as follows: fee structure (1.5% annual fee) and idiosyncratic selling depending on each shareholder's unique financial circumstance (cost basis, tax incentives, bankruptcy etc.).

Bankruptcy Estates

Estimated Ownership: 15% (89.5m shares | 77,000 BTC)

As of January 22, 2024 the FTX estate has liquidated its entire GBTC holdings of 22m shares (~20,000 BTC). Other bankrupt parties, including GBTC sister company Genesis Global (36m shares / ~32,000 BTC) and an additional (not publicly identified) entity holds approximately 31m shares (~28,000 BTC).

To reiterate: bankruptcy estates held approximately 15.5% of GBTC shares (90m shares / ~80,000 BTC), and likely most or all of these shares will be sold as soon as legally possible in order to repay the creditors of these estates. The FTX estate has already sold 22 million shares (~20,000 BTC), while it is not clear if Genesis and the other party have sold their stake. Taking all of this together, it is likely that a significant portion of bankruptcy sales have already been digested by the market aided in no small part by FTX ripping off the bandaid on January 22, 2024.

One wrinkle to add to the bankruptcy sales: these will likely not be smooth or drawn out, but more lump-sum as in the case of FTX. Conversely, other types of shareholders will likely exit their positions in a more drawn-out manner rather than liquidating their holdings in one fell swoop. Once legal hangups are taken care of, it is very likely that 100% of bankruptcy estate shares will be sold.

Retail Brokerage & Retirement Accounts

Estimated Ownership: 50% (286.5m shares | 255,000 BTC)

Next up, retail brokerage account shareholders. GBTC, as one of the first passive products available for retail investors when it launched in 2013, has a massive retail contingency. In my estimation, retail investors hold approximately 50% of GBTC shares (286m shares / ~255,000 bitcoin). This is the trickiest tranche of shares to project in terms of their optimal path forward because their decision to sell or not will depend upon the price of bitcoin, which then dictates the tax status for each share purchase.

For example, if the price of bitcoin rises, a greater proportion of retail shares will be in-profit, meaning if they rotate out of GBTC, they will incur a taxable event in the form of capital gains, thus they will likely stay put. However, the inverse is true as well. If the price of bitcoin continues to fall, more GBTC investors will not incur a taxable event, and thus will be incentivized to exit. This potential feedback loop marginally increases the pool of sellers that can exit without a tax penalty. Given GBTC’s unique availability to those early to bitcoin (therefore likely in profit), it is likely that most retail investors will stay put. To put a number on it, it is feasible that 25% retail brokerage accounts will sell, but this is subject to change depending upon bitcoin price action (as noted above).

Next up we have retail investors with a tax exempt status who allocated via IRAs (retirement accounts). These shareholders are extremely sensitive to the fee structure and can sell without a taxable event given their IRA status. With GBTC’ egregious 1.5% annual fee (six times that of GBTC’s competitors), it is all but certain a significant portion of this segment will exit GBTC in favor of other spot ETFs. It is likely that ~75% of these shareholders will exit, while many will remain due to apathy or misunderstanding of GBTC’s fee structure in relation to other products (or they simply value the liquidity that GBTC offers in relation to other ETF products).

On the bright side for spot bitcoin demand from retirement accounts, these GBTC outflows will likely be met with inflows into other Spot ETF products, as they will likely just rotate rather than exiting bitcoin into cash.

Institutional Shareholders

Estimated Ownership: 35% (200,000,000 shares | 180,000 BTC)

And finally, we have the institutions, which account for approximately 180,000 bitcoin. These players include FirTree and Saba Capital, as well as hedge funds that wanted to arbitrage the GBTC discount and spot bitcoin price discrepancy. This was done by going long GBTC and short bitcoin in order to have net neutral bitcoin positioning and capture GBTC’s return to NAV.

As a caveat, this tranche of shareholders is opaque and hard to forecast, and also acts as a bellwether for bitcoin demand from TradFi. For those with GBTC exposure purely for the aforementioned arbitrage trade, we can assume they will not return to purchase bitcoin through any other mechanism. We estimate investors of this type to make up 25% of all GBTC shares (143m shares / ~130,000 BTC). This is by no means certain, but it would reason that greater than 50% of TradFi will exit to cash without returning to a bitcoin product or physical bitcoin.

For Bitcoin-native funds and Bitcoin whales (~5% of total shares), it is likely that their sold GBTC shares will be recycled into bitcoin, resulting in a net-flat impact on bitcoin price. For crypto-native investors (~5% of total shares), they will likely exit GBTC into cash and other crypto assets (not bitcoin). Combined, these two cohorts (57m shares / ~50,000 BTC) will have a net neutral to slightly negative impact on bitcoin price given their relative rotations to cash and bitcoin.

Total GBTC Outflows & Net Bitcoin Impact

To be clear, there is a large amount of uncertainty in these projections, but the following is a ballpark estimate of the overall redemption landscape given the dynamics mentioned between bankruptcy estates, retail brokerage accounts, retirement accounts, and institutional investors.

Projected Outflows Breakdown:

- 250,000 to 350,000 BTC total projected GBTC outflows

- 100,000 to 150,000 BTC expected to leave the trust and be converted into cash

- 150,000 to 200,000 BTC in GBTC outflows rotating into other trusts or products

- 250,000 to 350,000 bitcoin will remain in GBTC

- 100,000 to 150,000 net-BTC selling pressure

TOTAL Expected GBTC-Related Outflows Resulting In Net-BTC Selling Pressure: 100,000 to 150,000 BTC

As of January 26, 2024 approximately 115,000 bitcoin have left GBTC. Given Alameda’s recorded sale (20,000 bitcoin), we estimate that of the other ~95,000 bitcoin, half have rotated into cash, and half have rotated into bitcoin or other bitcoin products. This implies net-neutral market impact from GBTC outflows.

Estimated Outflows Yet To Occur:

- Bankruptcy Estates: 55,000

- Retail Brokerage Accounts: 65,000 - 75,000 BTC

- Retirement Accounts: 10,000 - 12,250 BTC

- Institutional Investors: 35,000 - 40,000 BTC

TOTAL Estimated Outflows To Come: ~135,000 - 230,000 BTC

Note: as said previously, these estimates are the result of a heuristic analysis and should not be interpreted as financial advice and simply aim to inform the reader of what the overall outflow landscape may look like. Additionally, these estimates are pursuant to market conditions.

Gradually, Then Suddenly: A Farewell To Bears

In summary, we estimate that the market has already stomached approximately 30-45% of all projected GBTC outflows (115,000 BTC of 250,000-300,000 BTC projected total outflows) and that the remaining 55-70% of expected outflows will follow in short order over the next 20-30 trading days. All in, 150,000 - 200,000 BTC in net selling pressure may result from GBTC sales given that the significant proportion of GBTC outflows will either rotate into other Spot ETF products, or into cold storage bitcoin.

We are through the brunt of the pain from Barry Silbert’s GBTC gauntlet and that is reason to celebrate. The market will be much better off on the other side: GBTC will have finally relinquished its stranglehold over bitcoin markets, and without the specter of the discount or future firesales hanging over the market, bitcoin will be much less encumbered when it does arise. While it will take time to digest the rest of the GBTC outflows, and there will likely be a long tail of people exiting their position (mentioned previously), bitcoin will have plenty of room to run when the Spot ETFs settle into a groove.

Oh, and did I mention the halving is coming? But that’s a story for another time.

from Bitcoin Magazine - Bitcoin News, Articles and Expert Insights https://ift.tt/nfxoNvB

Bitcoin

1 Comments

Investing online has been a main source of income, that's why knowledge plays a very important role in humanity, you don't need to over work yourself for money.All you need is the right information, and you could build your own wealth from the comfort of your home! Binary trading is dependent on timely signals, assets or controlled strategies which when mastered increases chance of winning up to 90%-100% with trading. It’s possible to earn $10,000 to $20,000 trading weekly-monthly in cryptocurrency(bitcoin) investment, just get in contact with Mr Bernie Doran my broker. I had almost given up on everything about binary trading and never getting my lost funds back, till i met with him, with his help and guidance now i have my lost funds back to my bank account, gained more profit and I can now trade successfully with his profitable strategies and signals! Reach out to him on Gmail ( BERNIEDORANSIGNALS@GMAIL.COM ) , or his WhatsApp : +1(424)285-0682 for inquiries

ReplyDeleteThis blog is aimed at Software QA Engineers who know nothing about test automation. I was just like you six months ago. After much trial and error, I have successfully automated many tests, and I would like to share what I learned with you and hopefully save you some time and trouble!This blog is aimed at Software QA Engineers who know nothing about test automation. I was just like you six months ago. After much trial and error, I have successfully automated many tests, and I would like to share what I learned with you and hopefully save you some time and trouble!