Yield curve control is the next saga in the global monetary policy experiment. What does it mean for the economy and what are the future consequences?

The below is an excerpt from a recent edition of Bitcoin Magazine Pro, Bitcoin Magazine's premium markets newsletter. To be among the first to receive these insights and other on-chain bitcoin market analysis straight to your inbox, subscribe now.

Here Comes Yield Curve Control

A key theme in our long-term Bitcoin thesis is the continued failure of centralized monetary policy across global central banks in a world where centralized monetary policy will likely not fix, but only exacerbate, larger systemic problems. The failure, pent up volatility and economic destruction that follows from central bank attempts to solve these problems will only further widen the distrust in financial and economic institutions. This opens the door to an alternative system. We think that system, or even a significant part of it, can be Bitcoin.

With the goal to provide a stable, sustainable and useful global monetary system, central banks face one of their biggest challenges in history: solving the global sovereign debt crisis. In response, we will see more monetary and fiscal policy experiments evolve and roll out around the world to try and keep the current system afloat. One of those policy experiments is known as yield curve control (YCC) and is becoming more critical to our future. In this post, we will cover what YCC is, its few historical examples and the future implications of increased YCC rollouts.

YCC Historical Examples

Simply put, YCC is a method for central banks to control or influence interest rates and the overall cost of capital. In practice, a central bank sets their ideal interest rate for a specific debt instrument in the market. They keep buying or selling that debt instrument (i.e., a 10-year bond) no matter what to maintain the specific interest rate peg they want. Typically, they buy with newly printed currency adding to monetary inflation pressures.

YCC can be tried for a few different reasons: maintain lower and stable interest rates to spur new economic growth, maintain lower and stable interest rates to lower the cost of borrowing and interest rate debt payments or intentionally create inflation in a deflationary environment (to name a few). Its success is only as good as the central bank’s credibility in the market. Markets have to “trust” that central banks will continue to execute on this policy at all costs.

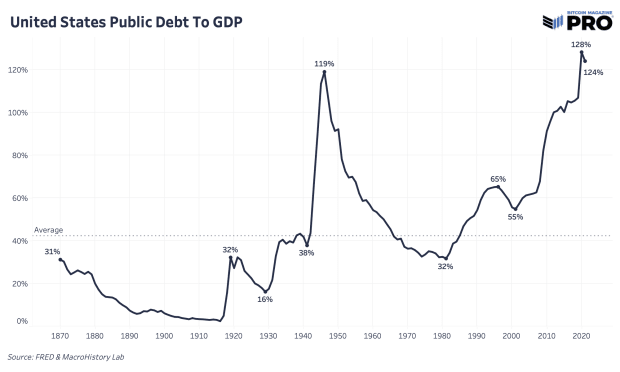

The largest YCC example happened in the United States in 1942 post World War II. The United States incurred massive debt expenditures to finance the war and the Fed capped yields to keep borrowing costs low and stable. During that time, the Fed capped both short and long-term interest rates across shorter-term bills at 0.375% and longer-term bonds up to 2.5%. By doing so, the Fed gave up control of their balance sheet and money supply, both increasing to maintain the lower interest rate pegs. It was the chosen method to deal with the unsustainable, elevator rise in public debt relative to gross domestic product.

YCC Current And Future

The European Central Bank (ECB) has effectively been engaging in a YCC policy flying under another banner. The ECB has been buying bonds to try and control the spread in yields between the strongest and weakest economies in the eurozone.

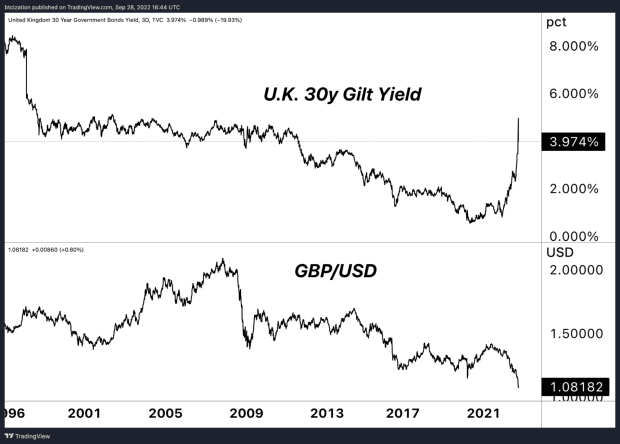

Yields have become too high too quickly for economies to function and there’s a lack of marginal buyers in the bond market right now as sovereign bonds face their worst year-to-date performance in history. That leaves the BoE no choice but to be the buyer of last resort. If the QE restart and initial bond buying isn’t enough, we could easily see a progression to a more strict and long-lasting yield cap YCC program.

It was reported that the BoE stepped in to stem the route in gilts due to the potential for margin calls across the U.K. pension system, which holds approximately £1.5 trillion of assets, of which a majority were invested in bonds. As certain pension funds hedged their volatility risk with bond derivatives, managed by so-called liability-driven investment (LDI) funds. As the price of long-dated U.K. sovereign bonds drastically fell, the derivative positions that were secured with said bonds as collateral became increasingly at risk to margin calls. While the specifics aren’t all that particularly important, the key point to understand is that when the monetary tightening became potentially systemic, the central bank stepped in.

Although YCC policies may “kick the can” and limit crisis damage short-term, it unleashes an entire box of consequences and second order effects that will have to be dealt with.

YCC is essentially the end of any “free market” activity left in the financial and economic systems. It’s more active centralized planning to maintain a specific cost of capital that the entire economy functions on. It’s done out of necessity to keep the system from total collapse which has proven to be inevitable in fiat-based monetary systems near the end of their shelf life.

YCC prolongs the sovereign debt bubble by allowing governments to lower the overall interest rate on interest payments and lower borrowing costs on future debt rollovers. Based on the sheer amount of public debt size, pace of future fiscal deficits and significant entitlement spending promises far into the future (Medicare, Social Security, etc.), interest rate expenses will continue to take up a greater share of tax revenue from a waning tax base under pressure.

Final Note

The first use of yield curve control was a global wartime measure. Its use was for extreme circumstances. So even the attempted rollout of a YCC or YCC-like program should act as a warning signal to most that something is seriously wrong. Now we have two of the largest central banks in the world (on the verge of three) actively pursuing yield curve control policies. This is the new evolution of monetary policy and monetary experiments. Central banks will attempt whatever it takes to stabilize economic conditions and more monetary debasement will be the result.

If there was ever a marketing campaign for why Bitcoin has a place in the world, it’s exactly this. As much as we’ve talked about the current macro headwinds needing time to play out and lower bitcoin prices being a likely short-term outcome in the scenario of serious equity market volatility, the wave of monetary policy and relentless liquidity that will have to be unleashed to rescue the system will be massive. Getting a lower bitcoin price to accumulate a higher position and avoiding another potential significant drawdown in a global recession is a good play (if the market provides) but missing out on the next major move upwards is the real missed opportunity in our view.

Relevant Past Articles

- 9/23/22 - The Unfolding Sovereign Debt & Currency Crisis

- 8/2/22 - July Monthly Report: Long Live Macro

- 9/7/22 - Europe: The Sovereign Debt Bubble Domino

- 7/20/22 - Caution: Bear Market Rallies

from Bitcoin Magazine - Bitcoin News, Articles and Expert Insights https://ift.tt/bUVK2CE

Bitcoin

0 Comments