New research shows the stark differences between states and their energy prices, policies that will define a generation.

- Bitcoin miners seek the cheapest sources of energy available to increase their profit margins.

- States with a deregulated energy grid, such as Texas and Wyoming, let customers choose between energy providers, attracting miners and fostering innovation.

- In contrast, highly regulated states with energy-limiting policies, like California and Connecticut, artificially elevate energy prices, pushing miners and innovation away.

- Bitcoin-friendly states will be the ones to benefit the most from innovation and technological development in the coming decades.

Bitcoin mining companies have flocked to the U.S. amid a hashrate exodus away from China, fueled by extensive investments in talent and equipment. In an industry whose profit is highly dependable on the price of power, mining farms deliberately select their location to ensure the highest margins. Some states allow customers to choose their energy providers, enabling lower costs and tailored solutions. Other regions, however, impose mandates, thereby inflating prices and pushing away businesses seeking to create jobs and join a community.

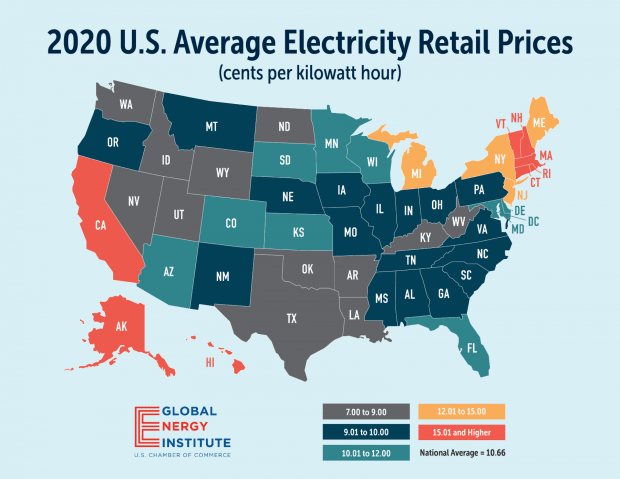

According to data from the Global Energy Institute, states like Texas and Washington have the lowest average price of electricity in the country. Unsurprisingly, both states are among the preferred destinations for bitcoin miners, who flock to where power is cheap since their variable costs are made up primarily of energy.

Texas, Washington, Wyoming, Utah, and a handful of other states provide customers with reliable energy at seven to nine cents per kilowatt-hour (kWh). However, energy prices in the U.S. can climb over to nearly double that in some states of the East and West coasts. California, Connecticut, Maryland, and a few other states bill customers at 15 cents or more per kWh, the highest energy retail price in the country.

“The map shows that there are stark differences from state to state,” the Global Energy Institute said. “While the energy mix available within a state will play a large role in state electricity prices, energy-limiting policies in some states act to artificially elevate prices, making the price of electricity much higher for consumers and businesses.”

The states with the highest energy prices are those that impose mandates and restrict choices. California, for instance, enforces several laws and incentives related to energy, including alternative fuels and vehicles, advanced technologies, and air quality. The state has long been committed to restricting the ability of energy providers to engage in oil and gas initiatives. In 2019, it prohibited approvals of new oil extraction wells and strongly opposed White House efforts to expand oil and gas extraction on federal lands. These conditions repel bitcoin miners and most businesses dependent on cheap energy away from the state of California.

Texas, on the other hand, “has a deregulated power grid that lets customers choose between power providers,” CNBC reported. This freedom of choice allows bitcoin miners to plug in the energy grid and enjoy cheap power while diminishing carbon emissions. Companies across the U.S., such as Upstream and Great American Mining, have been building bitcoin mining data centers specifically geared to leverage flared gas and stranded energy — abundant in the state. In Washington, hydroelectric power has enabled bitcoin mining farms to profit with renewable energy.

Whereas high scrutiny, intense regulation, and energy-limiting policies inflate energy prices and push miners away, freedom of choice and friendlier legislation enable lower costs and a more welcoming environment for interested farms to set up shop. As Silicon Valley becomes a thing of the past, Bitcoin states are set to become hotbeds of a new financial system based on sound money.

from Bitcoin Magazine: Bitcoin News, Articles, Charts, and Guides https://ift.tt/2ZA6j5N

Bitcoin

0 Comments